How to Use Your HSA for Vision Correction Surgery

![]()

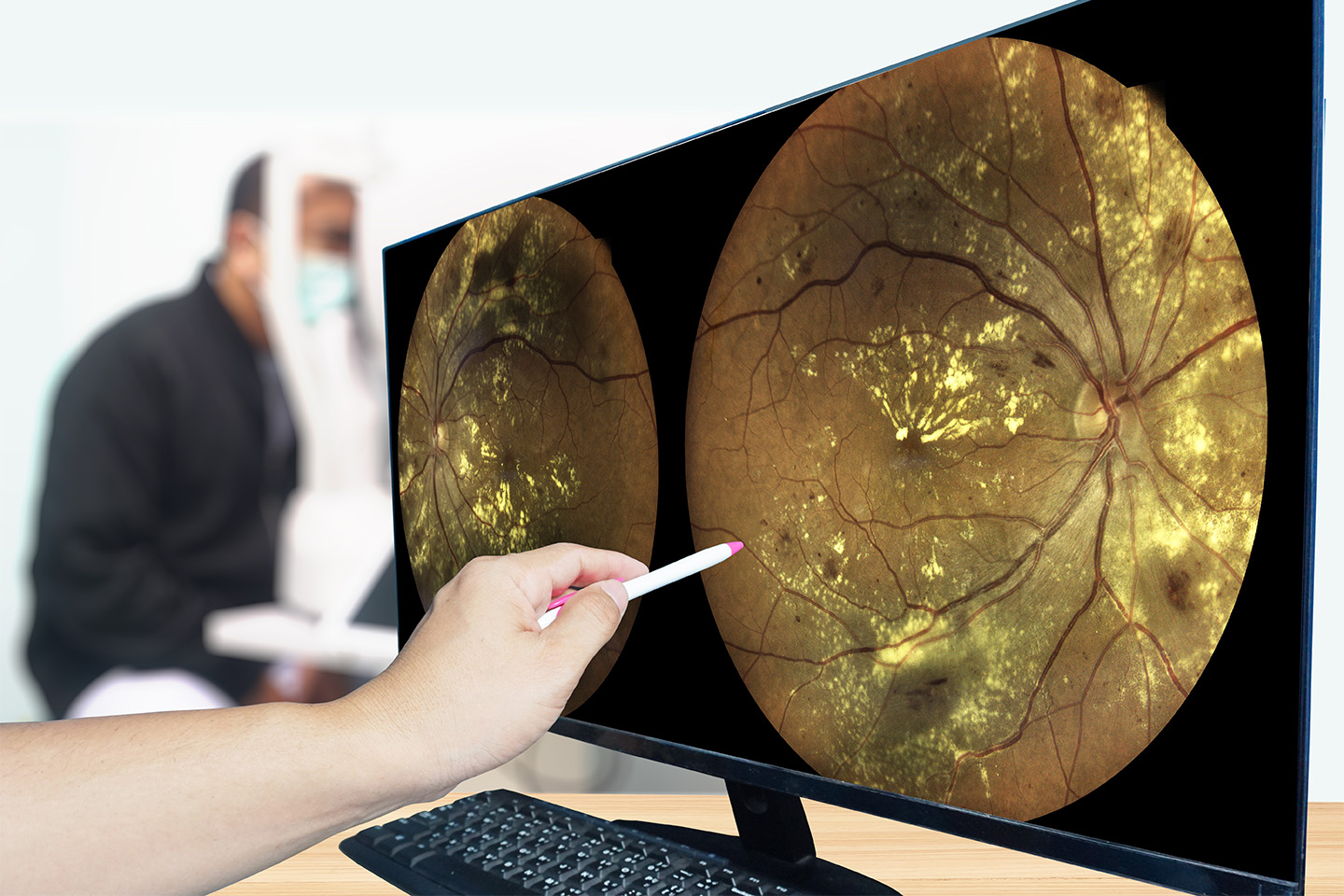

A Health Savings Account or HSA is a versatile way to save money for healthcare expenses not covered by your insurance. This includes several vision health procedures such as LASIK surgery. Are you wondering how an HSA works and how you can use it to pay for vision correction surgery with ICON Eyecare? We answer these questions and more in the sections below.

Our eye doctors in Grand Junction have helped thousands of patients determine their eligibility for laser vision correction. Even if you aren’t a great candidate for LASIK, we may recommend another laser vision correction technique, such as PRK, to improve your vision. Let’s find out if you can use your HSA account to pay for these procedures tax-free.

What Is an HSA?

Employers can implement a health savings account (HSA) to give their employees a tax-free way to save for medical expenses. To qualify for an HSA account, employees must first join a High Deductible Health Plan (HDHP).

If you join an HSA, your employer deducts an amount that you determine from your paycheck every month. They take the money out of your pretax income, meaning you pay no taxes on your HSA contribution. There is another huge advantage to participating in a health savings plan. You can roll over unused funds into the next year. You can accumulate funds in your HSA accounts for many years, creating an alternate form of savings for health emergencies or retirement.

4 Benefits of an HSA

Here are additional benefits of investing in a health savings account:

- You can pay copays, your high down payment, and many health care expenses not covered by your insurance.

- Procedures such as LASIK and other vision correction surgeries are listed on the IRS’ eligible medical expenses.

- Once you reach a certain minimum balance, you can invest some of your HSA savings in mutual funds, stocks and bonds.

- At age 65, you can withdraw HSA funds penalty-free for any reason.

Can I Spend My HSA on Vision Correction Surgery?

Yes! The IRS classifies LASIK, PRK, and other vision correction procedures, like cataract surgery, as eligible medical expenses.

How does it work?

The first step of using your HSA funds to pay for your vision correction surgery is to find out if you’re a candidate and learn which vision correction procedure is right for you. During your free consultation appointment, our team of eyecare experts will talk with you about what’s best for your vision and share costs for your chosen surgical treatment.

The first step of using your HSA funds to pay for your vision correction surgery is to find out if you’re a candidate and learn which vision correction procedure is right for you. During your free consultation appointment, our team of eyecare experts will talk with you about what’s best for your vision and share costs for your chosen surgical treatment.

There are a couple of things to be aware of when planning your HSA contributions:

- You only have access to money as you contribute to the account.

- You can use existing HSA funds as a sort of down payment on your vision correction procedure and then finance the remaining balance. ICON Grand Junction offers 0% financing for up to 24 months – saving you money!

- Thanks to the rollover benefit, another option is to save up your funds until you have enough to cover the entire cost.

Once you have the HSA funds you need, it’s time to schedule your vision correction surgery!

On surgery day, you can use those HSA funds. The key to keeping the funds tax-free is to retain your receipts as documentation that the funds were used for covered expenses.

Key Takeaways

An HSA is a great way to help offset the costs of vision correction surgery. Because you decide when and how much you’d like to contribute to your HSA, you choose when to schedule your vision correction surgery.

An important first step is to determine if you’re a candidate for vision correction surgery and learn about the cost so you can plan. Schedule a free consultation with one of our eye doctors at Grand Junction ICON Eyecare today.